PROBLEMS OF TRADITIONAL CREDIT BUSINESS AND THE SOLUTION: DISTRIBUTED CREDIT CHAIN (DCC)

As we all know, credit business has played an essential part in our lives for a very long time. However, the credit business in every country is replete with loopholes at every stage of the process, such as unclear rights and interests, high operating costs, inefficient operations, untrustworthy credentials, and privacy leaks. That's why Distributed Credit Chain (DCC) was organized, to solve all problems of traditional credit business.

1.WHAT IS CREDIT BUSINESS?

Definition of credit business: a credit activity where in the holder of certain currency positions temporarily lends an agreed-upon amount of money at an agreed-upon interest rate to a borrower, who repays the principal and interest according to the terms and period as agreed.

The fundamental function of the credit market is to adjust temporary or long-term funding shortfalls. Within the credit market, assets and capital can be properly allocated, allowing the smooth functioning of our economic system.

The history of the credit industry goes back a long way. Without credit, the massive expansion and progress of human civilization would not have been possible.

There are some major disadvantages of traditional credit business:

- Cost: The core model of a credit agency is to share the costs of non interest-earning elements and bad debts by charging the "good guys" who can pay back the money. For borrowers, it brings an additional cost.

- Efficiency: From the credit agency's perspective, a lot of time and efforts are wasted in verifying the credit of borrowers who do not meet the agencies’ risk criteria, which leads to wasting resources and decreasing efficiency.

- Borrower’s Interest

- Joint Debt

- Profiteering: A centralized credit model entices many financial institutions to deviate from their primary purpose— serving customers. Aiming for profitability, they deduct lenders while squeezing borrowers, and expand their profits by extending their customer base.

2.HOW DOES DCC WORK?

Distributed Credit Chain (DCC) is the world’s first distributed banking public blockchain with a goal to establish a decentralized ecosystem for financial service providers around the world. By empowering credit with blockchain technology and returning ownership of data to individuals, DCC’s mission is to transform different financial scenarios and realize true inclusive finance.

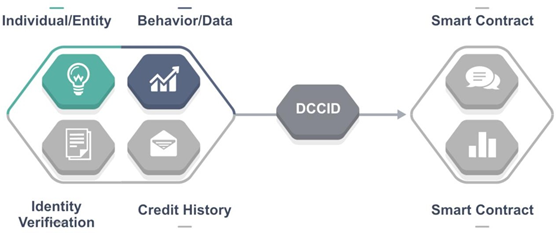

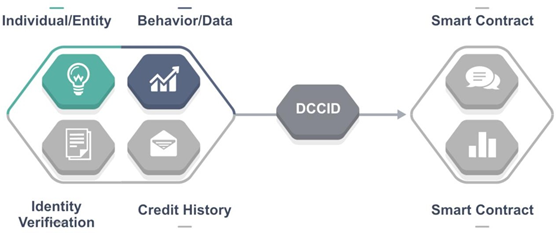

In DCC, each individual or institution has one DCCID generated through Public-Private Key Pair to form an address. This address acts just like a member ID in a traditional Internet system, identifying and associating various real-world attributes (such as real-name authentication, bank cards held, number of properties owned) and information on the credit chain—a loan request, loan, repayment, etc.

DCDMF uses AES symmetric encryption to encrypt data with the private key of DCCID and its input password (salt), and forms a data index with the cloud server through DCCID's wallet address. Users are able to obtain the data index at any moment conveniently through address of the DCCID, or quickly get the plain text data from the cloud using their own passwords.

DCDMF uses AES symmetric encryption to encrypt data with the private key of DCCID and its input password (salt), and forms a data index with the cloud server through DCCID's wallet address. Users are able to obtain the data index at any moment conveniently through address of the DCCID, or quickly get the plain text data from the cloud using their own passwords.

3.HOW CAN DCC SOLVE PROBLEMS OF TRADITIONAL CREDIT BUSINESS?

DCC helps to eliminate monoply, profiteering and data monoplies. Besides, it contributes to protect privacy reasonably, improve data validation efficiency and reduce data use cost. Furthermore, it create “data marketplace” and control AI risk thanks to blockchain platform.

- Borrowers: Individuals with specific borrowing demand establish blockchain account to authorize data service provider and Initiate borrowing request

- Data Service Provider: Integrate individual data and store them on the chain, clean dirty data, and provide data standards

- Algorithm & Computation Service Providers: Extract characteristics from data, make judgments based on policies and quantify judgment based on characteristics

- Credit History Feedback: The approved credit history reports generated on blockchains prevent problems such as long-term borrowing and repeated test borrowing.

- Funding providers: Not directly involved in lending but provide funding (such as ABS-purchasing institutions).

- Risk Assuming Institutions: Operate a credit business by earning income from bearing specific risks, manage loans in progress and collect after loan

4.MORE DETAILS ABOUT BLOCKCHAIN-BASED LENDING BUSINESS OF DCC:

- Data entry: With the help of the open source framework SDV (Submitting Data Validation), the lending institutions can easily input the user's data to their existing risk control system.

- Lending process: DCC suggests that the lending institutions should use chain data to maintain the lending process. The user's loan application can be submitted to the chain directly by the user via signature, and the lending institution obtains the entry data through the SDV and updates the approval result to the corresponding order.

- Credit Report: Through contracts on DCR (Distributed Credit Report), there will generate a list of credit history index in the DCC system that records the individual’s whole life cycle status from application for loans, review of loans, repayment, overdue loans, collection, and bad debt.

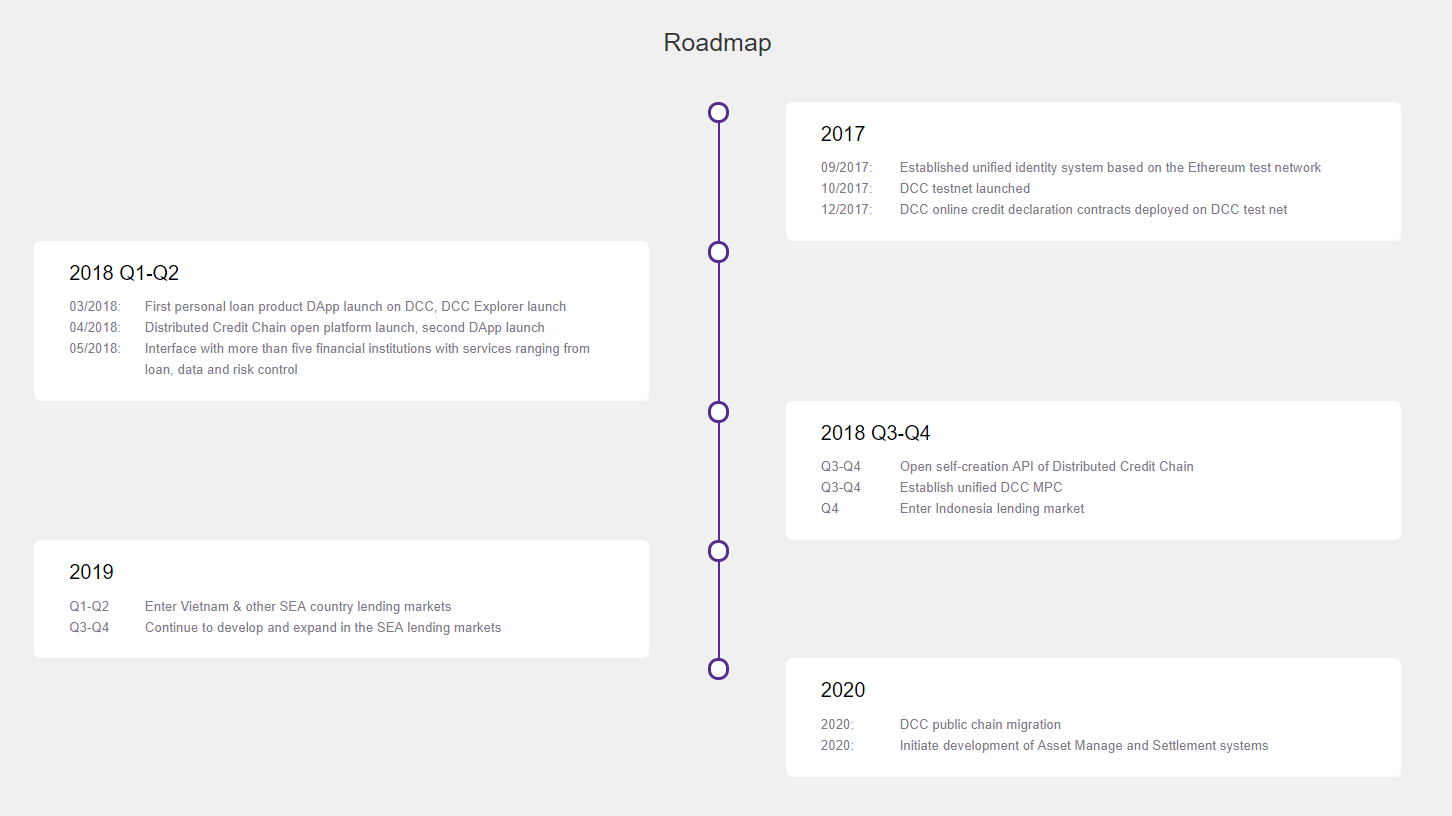

5.ROADMAP:

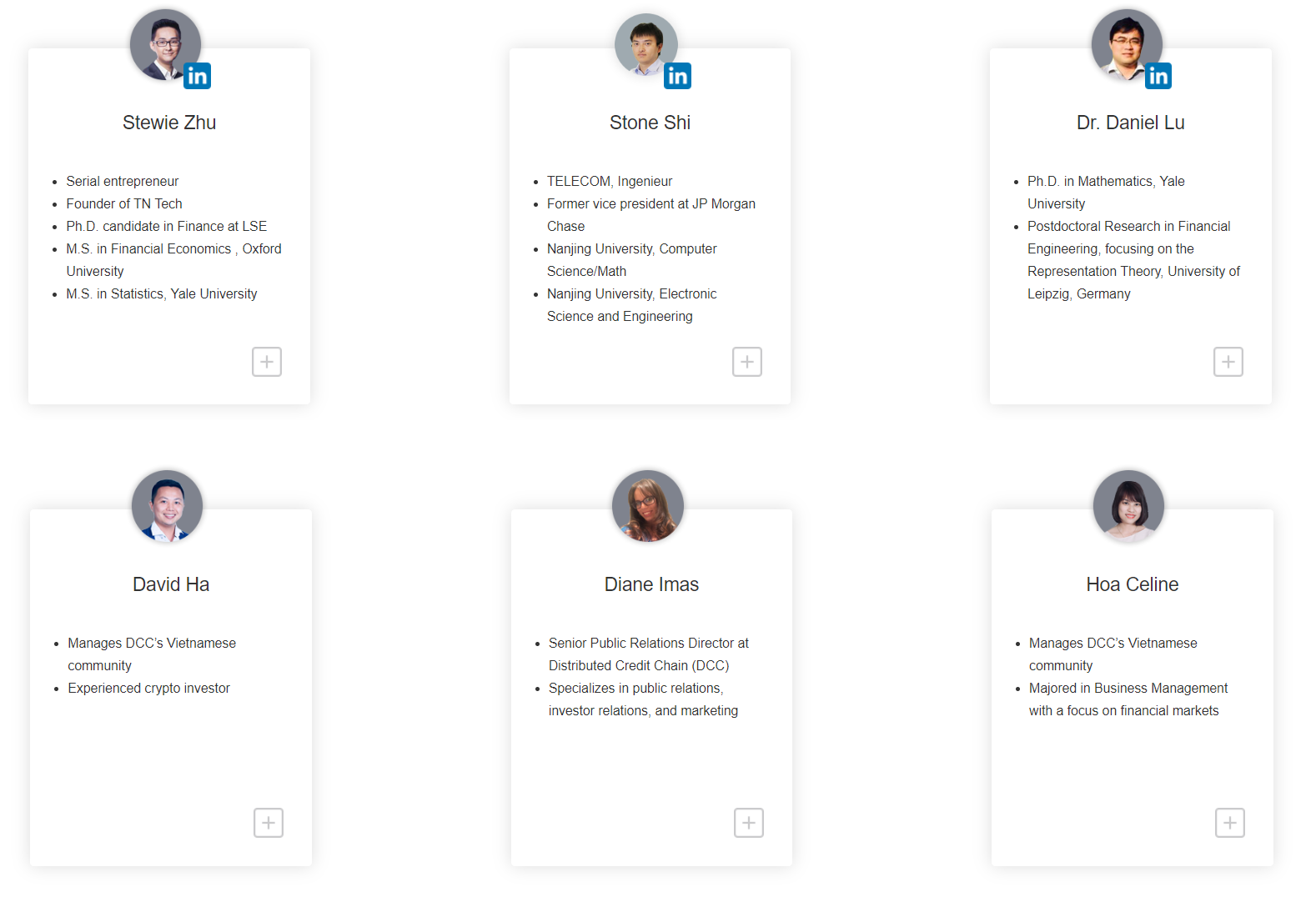

6.MORE INFORMATION ABOUT THEIR TEAM:

With the right direction, limitless potential as well as clear plans in the future of Distributed Credit Chain, many investors believe this project will make big strides in the credit business.

Thanks for reading my review. Have a nice day!

For more detailed information about this project, please click here:

Website: https://dcc.finance/

Whitepaper: https://dcc.finance/file/DCCwhitepaper.pdf

Facebook: https://www.facebook.com/DccOfficial2018/

Twitter: https://twitter.com/DccOfficial2018/

Telegram: https://t.me/DccOfficial

Whitepaper: https://dcc.finance/file/DCCwhitepaper.pdf

Facebook: https://www.facebook.com/DccOfficial2018/

Twitter: https://twitter.com/DccOfficial2018/

Telegram: https://t.me/DccOfficial

Author: Khuongcute2503

Bitcointalk profile: https://bitcointalk.org/index.php?action=profile;u=2080664

Comments

Post a Comment